This information was last updated on March 03, 2021

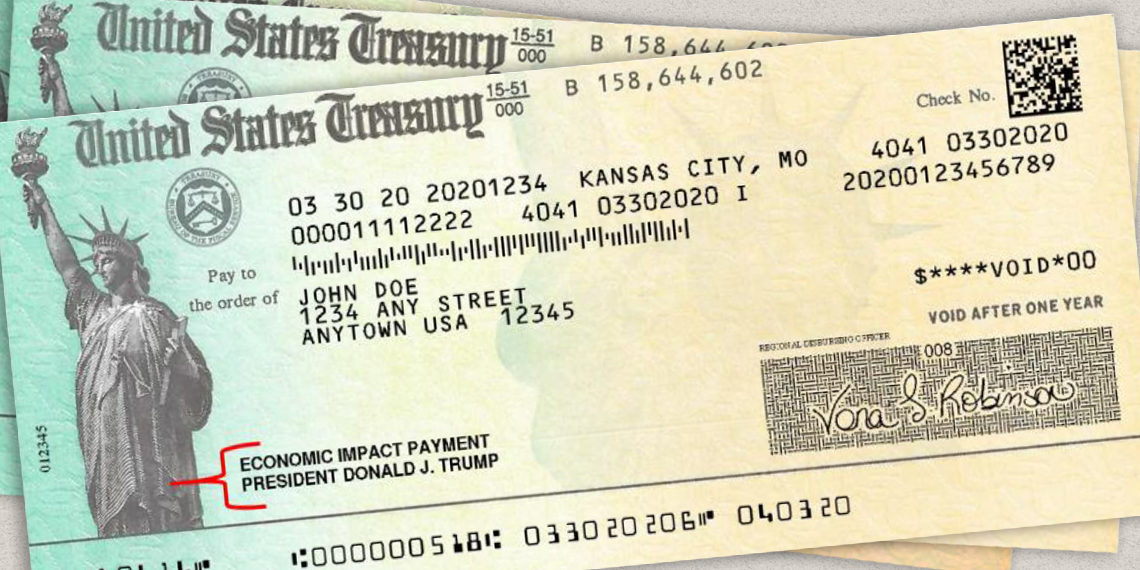

At the end of December 2020, the government began sending people a second stimulus cash payment (sometime called an “Economic Impact Payment” or “EIP”). A prior stimulus payment of $1,200 for most adults, and $500 for most children under 17 was sent out in Spring and Summer of 2020. Most people are entitled to a second stimulus payment of $600, and an additional $600 for each child under the age of 17. If you have questions about whether you are eligible for the second stimulus payment, click here. Most people did not have to take any action to get their second stimulus payment. It was sent through direct deposit, check or debit card. If you are not sure if you received it, it was usually sent the same way you got the first one. The government finished sending out these payments on January 15, 2021.

What Should I Do If I Haven't Received My Payment?

Check Your Mail

- If your payment was sent in the mail, it may take up to 4 weeks to get it.

- Keep an eye out for EIP debit cards and do not throw them away. They are not a scam and arrive in a mostly white envelope with a U.S. Department of Treasury Seal.

- If you do not receive anything by February 12, 2021, consider filing taxes

File Your Taxes

- If you did not receive any or all of your first or second stimulus payment by February 12, 2021, and it is not on its way, you must file a 2020 tax return and request a Recovery Rebate to get the payments. You can file for this tax return even if you do not have income, and do not normally file taxes.

Free Help Is Available to File Taxes

- You may qualify to file for free yourself here.

- You may also qualify for free tax preparation services:

- If you live in Pennsylvania, the Campaign for Working Families may be able to help you file your faxes online for free.

- If you live outside Pennsylvania, you may qualify for free assistance from an IRS Volunteer Income Tax Assistance (VITA) clinic.

If you opt to pay someone to prepare your taxes, please read this first.